child tax credit payment schedule for september 2021

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The next child tax credit payment comes out on the 15th of September and individuals have to understand that they would be receiving only half of the payments this year while the rest of them will be coming through in 2022 when one files their taxes.

Childctc The Child Tax Credit The White House

E-File Directly to the IRS.

. Oliver Povey Olabolob Update. We dont make judgments or prescribe specific policies. Enter your information on Schedule 8812 Form.

15 opt out by Nov. Up to 300 dollars or 250 dollars depending on. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. Children who are adopted can also qualify if theyre US citizens. It also made the.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Wait 10 working days from the payment date to contact us. The Child Tax Credit provides money to support American families.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Up to 300 dollars or 250 dollars depending on age of child August 15 PAID. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Get your advance payments total and number of qualifying children in your online account. The payments will be paid via direct deposit or check. Home of the Free Federal Tax Return.

Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. Three payments of the credit have already been sent out and three more are to come in 2021 with the next one due on October 15. To reconcile advance payments on your 2021 return.

If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. Children who are adopted can also qualify if theyre US citizens. The complete 2021 child tax credit payments schedule.

That drops to 3000 for each child ages six through 17. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The money starts phasing out if you earn.

Child Tax Credit Payment Schedule for 2021. The payments will be paid via direct deposit or check. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment.

Each payment will be up to 300 for each qualifying child under the age of 6 and up. What Is The Child Tax Credit Payment Schedule. September 24th 2021 0858 EDT.

All payment dates. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17. October 5 2022 Havent received your payment.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. See what makes us different. Here is some important information to understand about this years Child Tax Credit.

How much will parents receive in September. Each payment will be up to 300 for each qualifying child under the age of 6 and up. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

July August September and October with the next due in just under a week on November 15. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Will There Be Another Check In April 2022 Marca

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

American Opportunity Tax Credit Aotc Definition

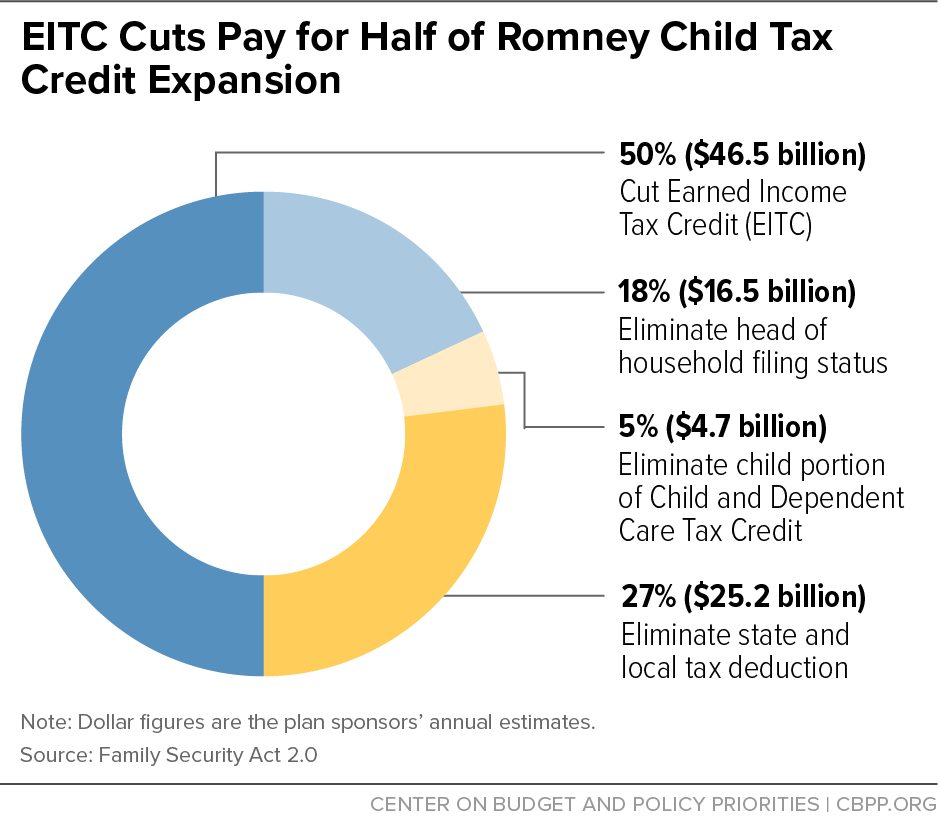

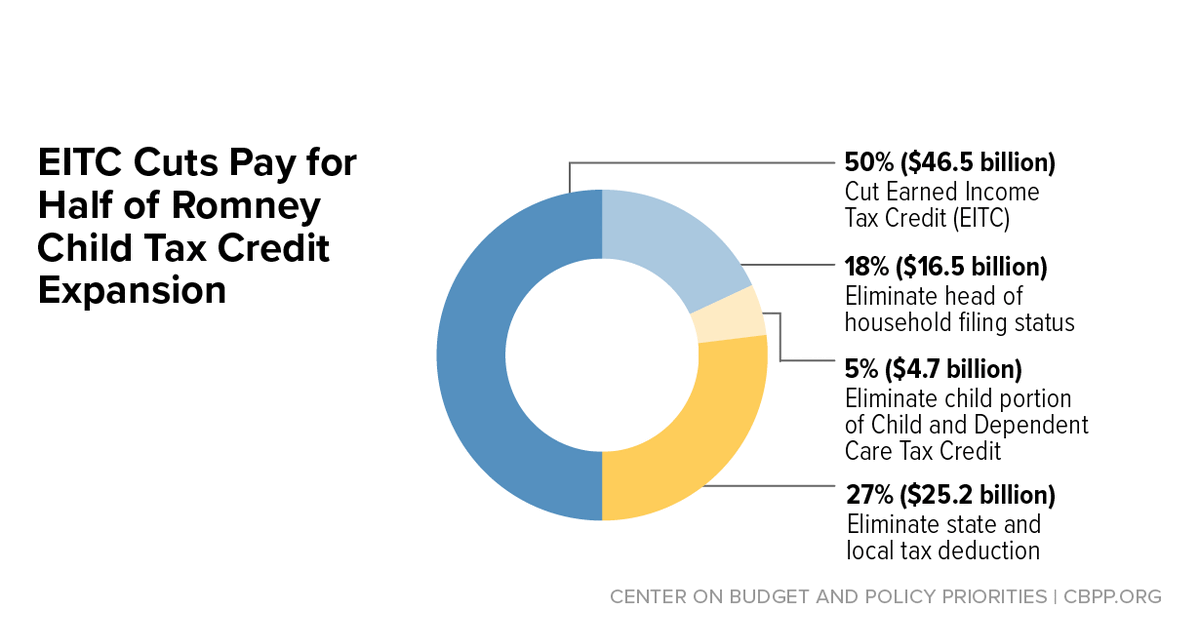

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit In 2022 Is Your State Sending 750 To Parents Find Out Now Cnet

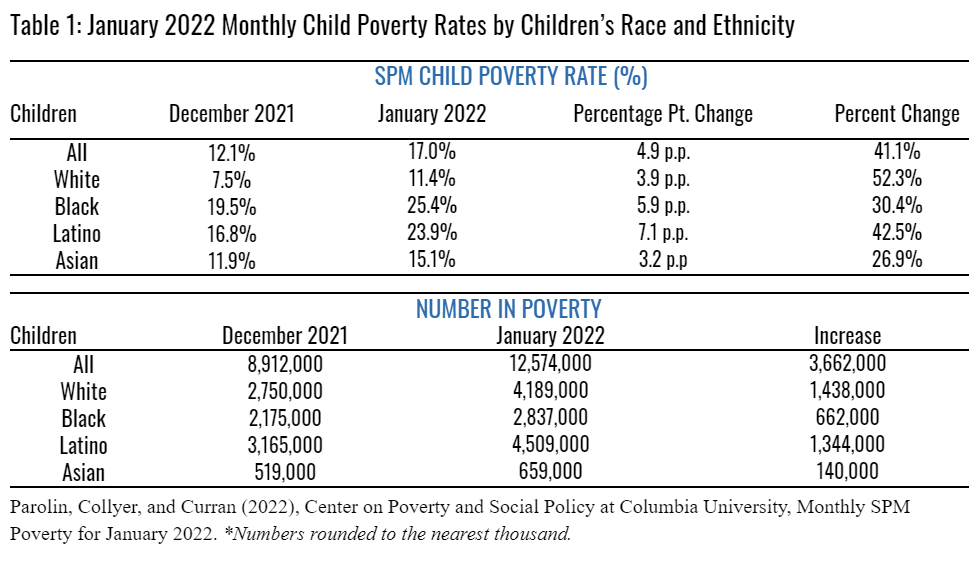

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet