cap and trade vs carbon tax canada

A cap-and-trade system meanwhile is a market-based approach to controlling carbon emissions. April 9 2007 413 pm ET.

Difference Between Carbon Tax And Cap And Trade Difference Between

A carbon tax was considered by the Clinton Administration in 1992 but quickly became loaded down with special exemptions was redirected away from carbon to be a BTU tax to avoid burdening coal and was ultimately enacted as a few pennies tax on gasoline.

. The carbon tax is a financial measure of the actual cost of greenhouse gases and its impact on the economy Carbon Tax or Cap-and-Trade 2014. Cap and Trade 1290 Words 6 Pages All across the world in every kind of environment and region known to man increasingly dangerous weather patterns and devastating storms are abruptly putting an end to the long-running debate over whether or not climate change is real. With a carbon tax there is.

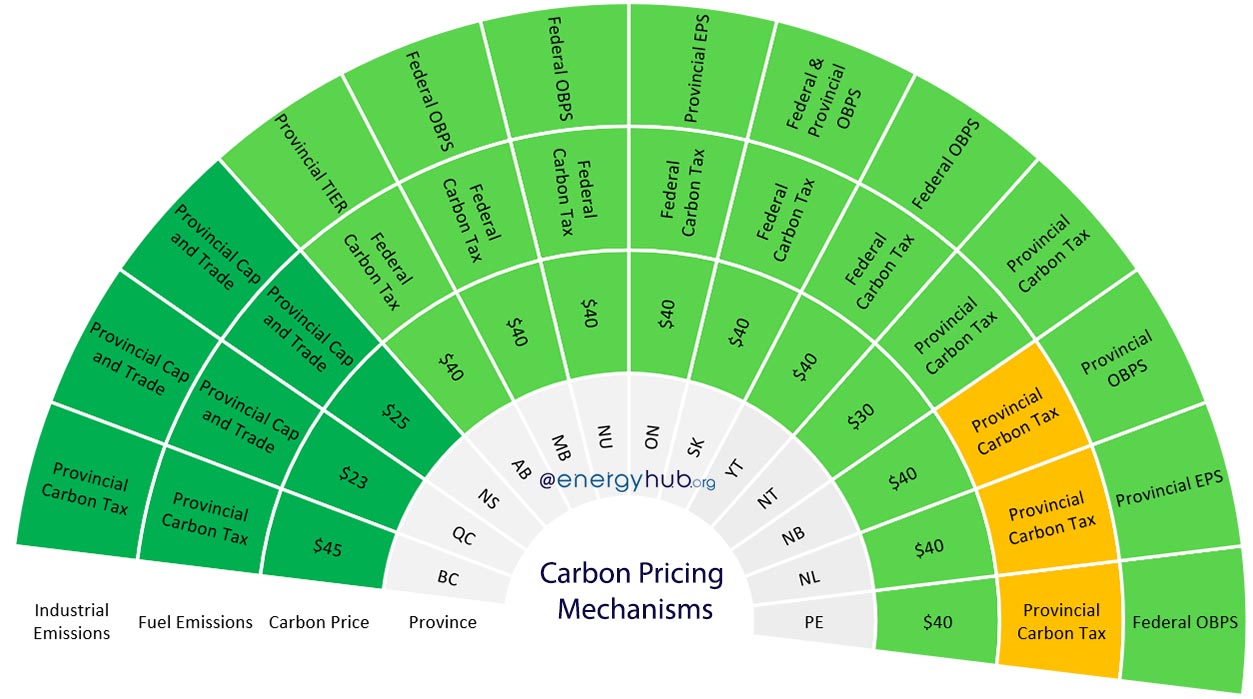

British Columbia for instance has its own higher carbon tax in place which rose to 30 per ton this year and Quebec has enacted a local cap-and-trade system. Carbon taxes vs. Peter MacdiarmidGetty Images G r.

A carbon tax and cap-and-trade are opposite sides of the same coin. The cap typically decreases each year to cut down the total. A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a.

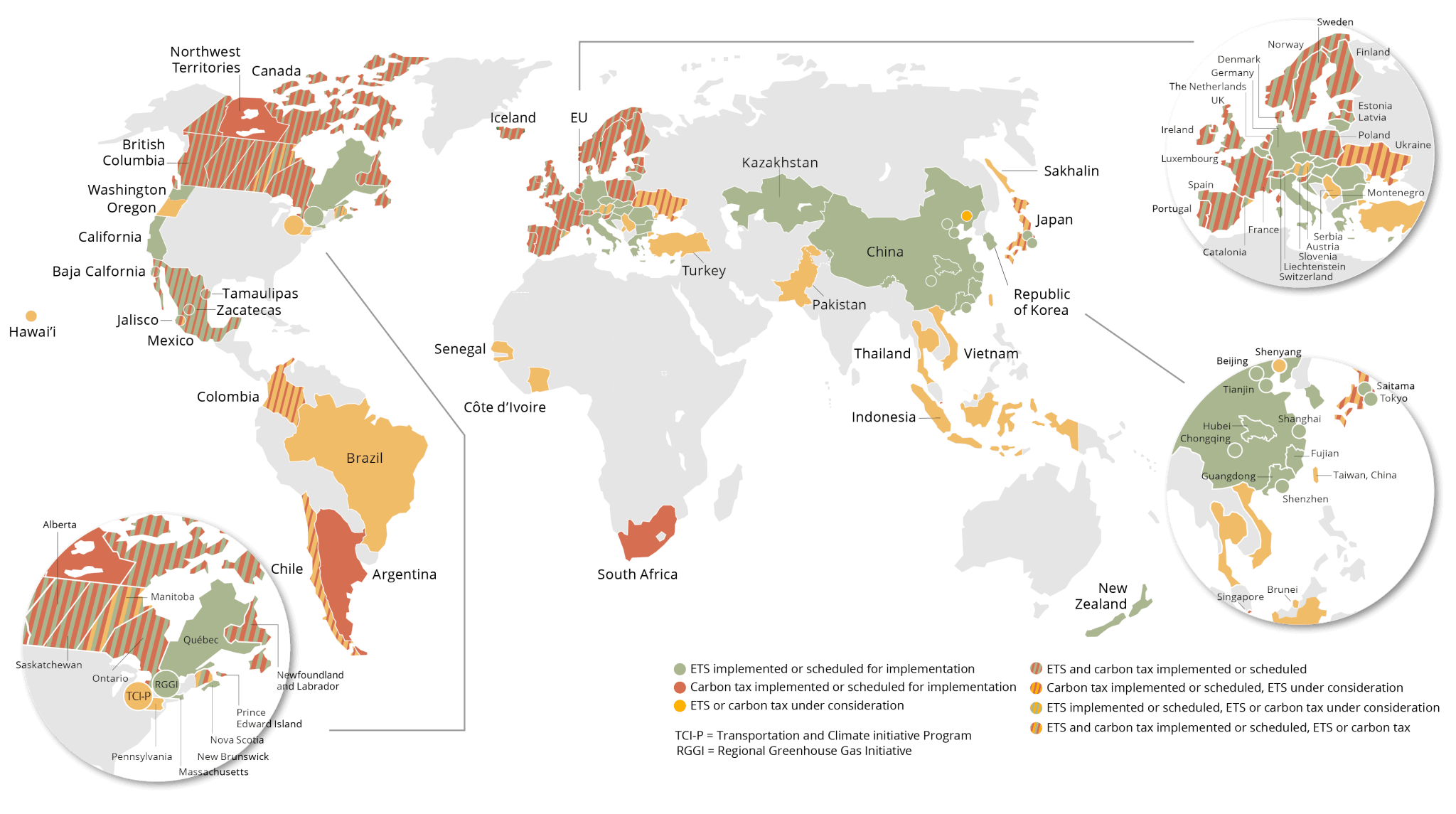

They lean toward a cap-and-trade system which would set a limit on carbon-dioxide emissions and require companies to obtain permits to release. The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the buildup of greenhouse gas emissions. Californias cap and trade system provides additional relief to sectors at high risk of carbon leakage and with more than 50 process emissions.

Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so. Deck of standard 52 cards. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences.

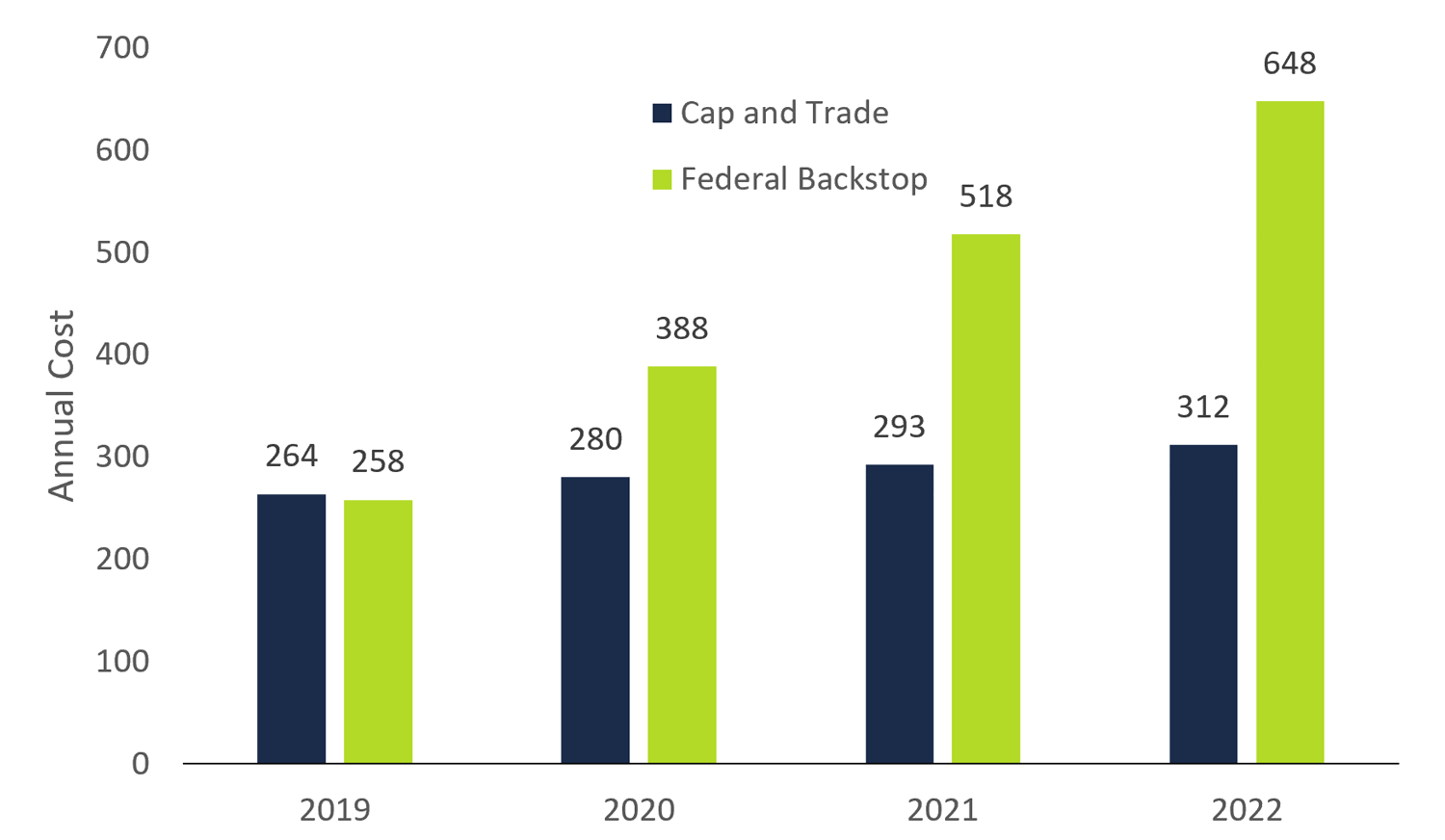

Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario. Quebecs cap and trade system provides 100 relief to process emissions. With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms.

In the United States Californias climate policies have led to a steady decline of the states carbon dioxide pollution. Carbon Tax - The size of a tax on the carbon content of fuels gives a level of certainty to what the final price will be. This was partly due to lower production volume overall but the bulk of the difference stemmed from the firms technology choice with greater adoption of the cleaner CCS technology under cap-and-trade than under the carbon tax setting.

Comparison of Carbon Tax and Cap Trade. A Carbon Tax vs Cap-and-Trade. If a litre of gasoline costs 095 one day and 105 the next.

Carbon Tax vs. Experts often debate the pros and cons of a carbon tax versus a cap-and-trade system in the United States and they will do so again at an event in Washington DC tomorrowA carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a cap-and-trade program. Under a cap-and-trade system governments impose a strict quota or cap on the overall level of carbon pollution that can be generated.

The centerpiece is the cap-and-trade program which EDF has helped design and implement. This review of cap and trade and taxes suggests that many of the longstanding myths about. Californias emissions from sources subject to the cap declined 10 between the programs launch in 2013 and 2018.

A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. This tax will then increase by 10tonne every year until it reaches 50tonne in 2022. While the federal Liberals tell us that its essential to have a carbon tax that will rise to 170 a tonne by 2030 Quebecs cap-and-trade plan which requires emitters to.

Comparison of Carbon Tax and Cap. Starting in 2021 process emissions will be subject to a tightening rate of 05 per year. In Quebec and Nova Scotia the governments cap the amount of emissions theyll allow each year then hold quarterly auctions so companies can buy emissions credits within that amount.

Joe wasnt defending cap-and-trade as such against the carbon tax alternative -- he was defending Waxman-Markey including all its complementary policies against the tax alternative Ryan Avent says taxes and caps are not that different in effect and only one has a chance of passing so carbon taxers should STFU. Cap and Trade. Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways.

Now that weve explored both the option of implementing a carbon tax for emissions or regulating them under a cap and trade scheme lets take a closer look at what the differences are. It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. Essay on Carbon Tax vs.

While the price of fuels are subject to market forces and fluctuate accordingly the size of the carbon tax is the same over the long run and is simply added on top of whatever the market price is at the time. In the provincial scenario a legislature will set an emissions cap a set tonnage that individual emitters must stay under. Carbon Tax vs.

The following are the authors final thoughts on the. Two types of tokens poker chips pieces of candy board game pieces etc. Theory and practice Robert N.

Cap and trade. Economists usually prefer taxation over quality controls due to incentives such as the continual motivation to reduce consumption on the taxed pollution Brander 2014 p. List mechanisms that limit externalities through a a carbon tax and b a cap and trade system and describe the effects of these mechanisms on trade.

The paper is written by the Chambers Senior Economist Tina Kremmidas.

Climate Change Not Looking So Hopeless A Map Of Climate Change Policies Around The World Link To Pdf Of Source Report In Comments Climate Change Policy Climate Change Climate Policy

The Carbon Tax For Dummies Why Do We Need It And What Will We Pay Greenhouse Gases Energy Conservation Greenhouse Gas Emissions

Green City Times Carbon Cap And Trade Putting A Price On Carbon Cap And Trade Climate Reality Climate Adaptation

Archive World Bank Group President Jim Yong Kim On Twitter Cap And Trade Climate Reality Climate Adaptation

![]()

44 Ccl Carbon Fee Tax And Dividend Jobs Youtube Dividend Job Carbon

Canadian Carbon Prices Rebates Updated 2021

44 Ccl Carbon Fee Tax And Dividend Jobs Youtube Dividend Job Carbon

Ted Nugent Tells Tucker Tyrants Can Kiss His A Youtube Kissing Him Ted Tucker

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

What Is Canada S National Carbon Tax And How Does It Affect Us Futurelearn

Opinion Why A Carbon Tax Won T Solve Climate Change Climate Change Climate Change Debate Human Behavior

Antarctica Effects Of Global Warming Global Warming Antarctica

Gut Wrenching Military Report Sheds Light On Grim Conditions In Ontario Nursing Homes In 2020 Ontario Home Care Canadian Soldiers

Our Energy Transition Away From Fossil Fuels Solar Energy Business Solar Energy Renewable Energy

44 Ccl Carbon Fee Tax And Dividend Jobs Youtube Dividend Job Carbon

The Ief Is Creating A New Methodology For Quantifying Emissions From The Energy Industry Its Chief Economist Tells Ngw In A Methane Online Publications Gas

Cap And Trade Basics Center For Climate And Energy Solutions